EXCLUSIVE: The Devil Went Down To Georgia He Was Looking For A Soul To Steal...

Someone Willingly Obliged... The People of Georgia Need Answers...

What happens when a former Georgia Secretary of State “wins” their election to become governor?

Would they be more or less likely to know election law?

Would a Georgia County District Attorney prosecuting “election crimes” and RICO crimes be knowledgeable on Georgia election code and potential crimes related to elections?

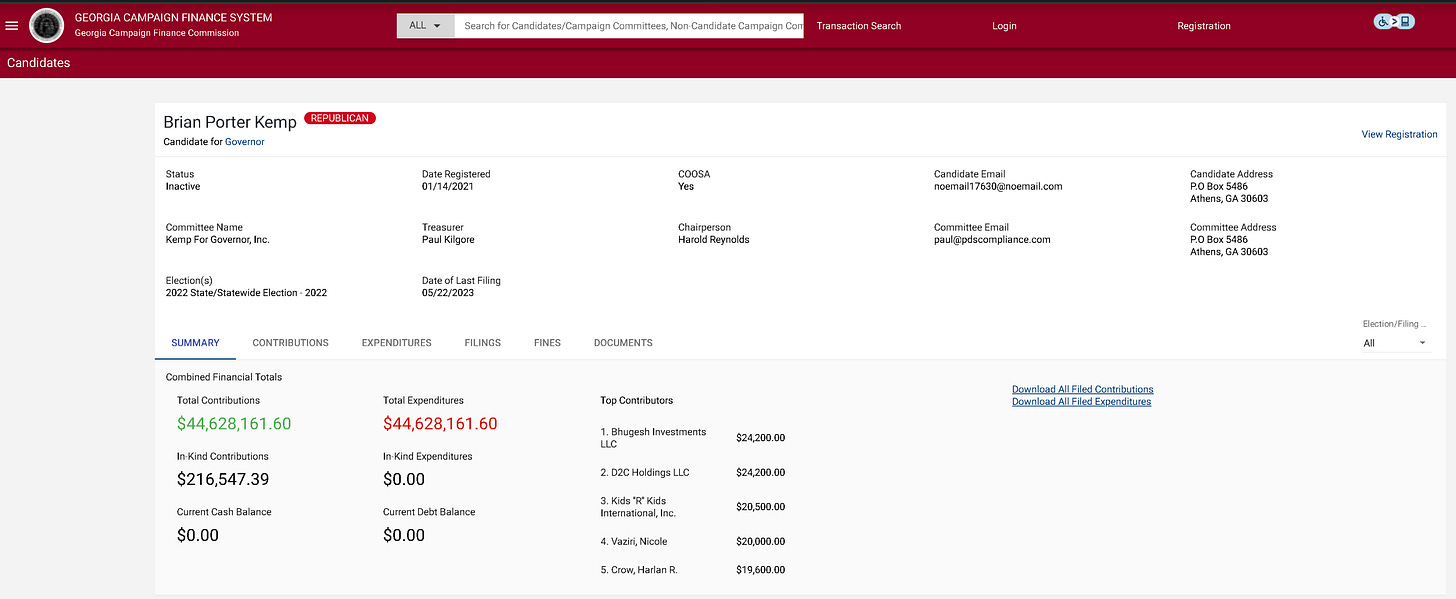

We recently obtained a document from Georgia related to Georgia Candidates for 2022. Here is a link to the document.

Let’s take a look at page #3, it discusses two relevant points that we should look at.

Campaign Record Keeping - Must be kept for 3 years, should probably keep for 5.

Anonymous Contributions - Are “STRICTLY PROHIBITED”

So… ANONYMOUS CONTRIBUTIONS are strictly prohibited?

Really? How interesting…

We covered the 222 “ANONYMOUS CONTRIBUTIONS” that Fani Willis received last year. News Guard tried to “fact check” our initial reporting on these “contributions” and other issues that we identified with Fani Willis being linked to the ActBlue money laundering RICO operation. We responded to the “Fact Checkers” and Georgia Election Experts directly and oddly they had zero comment or rebuttable for the questions that we asked of them. Funny how that works isn’t it…

We also took a look at Brian Kemp’s campaign for Georgia governor. The campaign finance reports that we obtained directly from the State of Georgia at at time showed a massive number of “ANONYMOUS CONTRIBUTIONS” 12,758. We also had identified that Brian Kemp appeared to be receiving contributions from the same WinRed “SMURF” network as Kevin McCarthy, Mitch McConnell, and Lindsey Graham.

Earlier this week in updating some information on the Fani Willis campaign finance investigation into her “SMURFS”, something interesting caught my attention. The 222 “ANONYMOUS CONTRIBUTIONS” were missing.

Step #1 - Go to GA Ethics Website

STEP #2

Click on Download All Filed Contributions

STEP # 3 - OPEN DOWNLOADED ALL CONTRIBUTIONS FILE

STEP # 4 - REVIEW ALL CONTRIBUTIONS REPORT

Hey!!! No more “ANONYMOUS CONTRIBUTIONS”? What happened?

Did someone make a deal with the devil?

I then checked Brian Kemp’s campaign finance reports as well.

Try it for yourself.

The most recent direct download was odd too. Kemp’s 12,758 “ANONYMOUS CONTRIBUTIONS” were now nowhere to be found as well.

Weird, how could this be?

But rest assured…We know things…

Here is a small sample of what we know…

There was previously 12,758 “ANONYMOUS CONTRIBUTIONS” that were “missing required information” like NAMES, ADDRESSES, EMPLOYMENT, etc…

However, we did see Transaction Amounts, Transaction Dates, Transaction ID.

We cross referenced both sets of reports, for Fani Willis and Brian Kemp.

Old Reports vs New Reports - The Delta

It appears that something crazy happened.

All 222 of Fani Willis Anon Data went POOF…

All 12,785 of Brian Kemp Anon Data went POOF…

NO MORE DATA… Is someone in Georgia hiding something? Did they make a deal with the devil?

Here is a link to a google sheet with all of the now missing Anons. Check the Transaction IDs for yourself. https://docs.google.com/spreadsheets/d/1-0KiGm438gaBfp5aTcH-3TDqDLTt3ixReyaCL6_tr60/edit?usp=sharing

https://docs.google.com/spreadsheets/d/10dxv1AKUT1FWWzBsxYgT9rvEvTl2hs2StmcXi_pGseU/edit?usp=sharing

For someone really adventurous you could do a Georgia Open Records Request to the State of Georgia and inquire where did all of these individual contributions go. We have the Amount, Date and TRANSACTION ID… Now you do too…

How did these records disappear?

Did they devil make them disappear or was it the individual(s) who made the deal with the prince of darkness?

Aren’t there laws related to official election records and public records?

Yes, there certainly is. Georgia has several regulations and legal codes that address electronic records keeping requirements, digital checksums, hashing, and audit logs to ensure the integrity and security of electronic records. Here are some relevant provisions:

Georgia Electronic Records Act (O.C.G.A. §§ 50-18-90 to 50-18-95): This act establishes guidelines and standards for the creation, management, and preservation of electronic records by state and local government agencies in Georgia. It includes provisions for the authenticity, reliability, and integrity of electronic records, including requirements for electronic signatures and the use of encryption to ensure security.

Georgia Uniform Electronic Transactions Act (O.C.G.A. §§ 10-12-1 to 10-12-18): This act provides a legal framework for electronic transactions and records in Georgia, including provisions for the integrity and security of electronic records. It recognizes electronic signatures and records as legally valid and enforceable, subject to certain requirements and standards for authentication and integrity.

Georgia Cybersecurity Law (O.C.G.A. §§ 50-25-1 to 50-25-7): This law establishes requirements for cybersecurity practices and incident response planning for state agencies and certain businesses in Georgia. While it primarily focuses on cybersecurity measures to protect against cyber threats and data breaches, it may include provisions related to electronic records integrity and security.

Georgia Open Records Act (O.C.G.A. §§ 50-18-70 to 50-18-77): While primarily focused on public access to government records, the Open Records Act also includes provisions related to the retention and preservation of electronic records by government agencies in Georgia. These provisions may indirectly address electronic records integrity and security by ensuring the availability and authenticity of electronic records to the public.

The good people of Georgia need to be asking some tough questions. Here are the questions that come to mind.

A. Who changed the campaign finance reports?

B. Who altered these public records?

C. As “Electronic Records” authenticity, reliability, and integrity of electronic records, including requirements for electronic signatures provide safeguards for alteration. There is an “OFFICIAL” public record of this activity. Where are the auditable logs of changes and access to these systems?

D. Where are the “Newly Disappeared Contributions Transaction Records” ? There are afterall 12,758 unique “TRANSACTION ID NUMBERS” with dates and dollar amounts.

E. Who is responsible for these records and this data? Kemp? Raffensberger? Is it the Georgia Ethics Commission?

It would appear that there are some “ETHICAL” implications in Georgia that need a high degree of scrutiny. There needs to be full and open disclosure of what is going on. Sunlight is the best disinfectant.

Someone or several individuals swore an oath to GOD that they were going to do things… In their assuming office, in their official capacity they executed an oath.

We know a tree by its fruit. We know the enemy by his works. The devil came to steal, kill and destroy. The devil is the father of lies. Whatever has been promised for the selling of their soul for the breach of public trust and the violation of that solemn oath is not worth whatever has been promised.

If you know something, say something. It’s not too late to repent of your sins and turn from your wicked ways…

We have so much documented, even if you have a compromised judiciary, the evidence is so overwhelming that there is no escaping this.

What are you looking at? Felonies… Lots and lots of felonies…

Let's explore some potential areas of the Georgia Code where intentionally using incomplete and false information on campaign finance reports might constitute violations of Georgia laws:

Incomplete Reporting (O.C.G.A. § 21-5-34): This section requires that campaign finance reports contain detailed information about contributors, including their full names. Failure to provide complete information could be interpreted as a violation of this provision.

Fraudulent Practices (O.C.G.A. § 21-2-570): This section prohibits various fraudulent practices related to elections, including the submission of false or misleading information. Using only initials instead of full names might be construed as an attempt to deceive or mislead authorities or the public, potentially violating this statute.

Record-Keeping Requirements (O.C.G.A. § 21-5-35): Georgia law imposes specific record-keeping requirements on campaign committees, including the maintenance of accurate and complete records of contributions. Using only initials may not satisfy these requirements and could be seen as a violation of this statute.

Identification of Contributors (O.C.G.A. § 21-5-34(a)(2)): This provision mandates that campaign finance reports include the full names, addresses, and other relevant information of contributors. Failing to provide full names may contravene this requirement.

Penalties for Violations (O.C.G.A. § 21-5-38): This section outlines the penalties for violations of Georgia's campaign finance laws, which can include fines, penalties, or other legal consequences. Knowingly and willingly making false statements and intentionally omitting required information on campaign finance reports could potentially subject individuals or committees to these penalties if found to be in violation of the law.

Then you have the following:

2022 Georgia Code

Title 16 - Crimes and Offenses

Chapter 10 - Offenses Against Public Administration

Article 2 - Obstruction of Public Administration and Related Offenses

§ 16-10-20. False Statements and Writings, Concealment of Facts, and Fraudulent Documents in Matters Within Jurisdiction of State or Political Subdivisions

Violating Georgia Code § 16-10-20.1, which pertains to filing false documents, is considered a felony. Upon conviction, penalties include imprisonment ranging from one to ten years, a fine not exceeding $10,000, or both.

AND WE HAVEN’T EVEN HIT THE MONEY LAUNDERING / RICO ENTERPRISE CHARGES YET…

It looks like there is a vast conspiracy going on in Georgia. Who is involved?

It’s time for the proverbial “Come to Jesus” chat…